The Future of Offshore Investment and Just How It's Progressing in the Global Market

The Future of Offshore Investment and Just How It's Progressing in the Global Market

Blog Article

Comprehending the Kinds Of Offshore Investment and Their Special Features

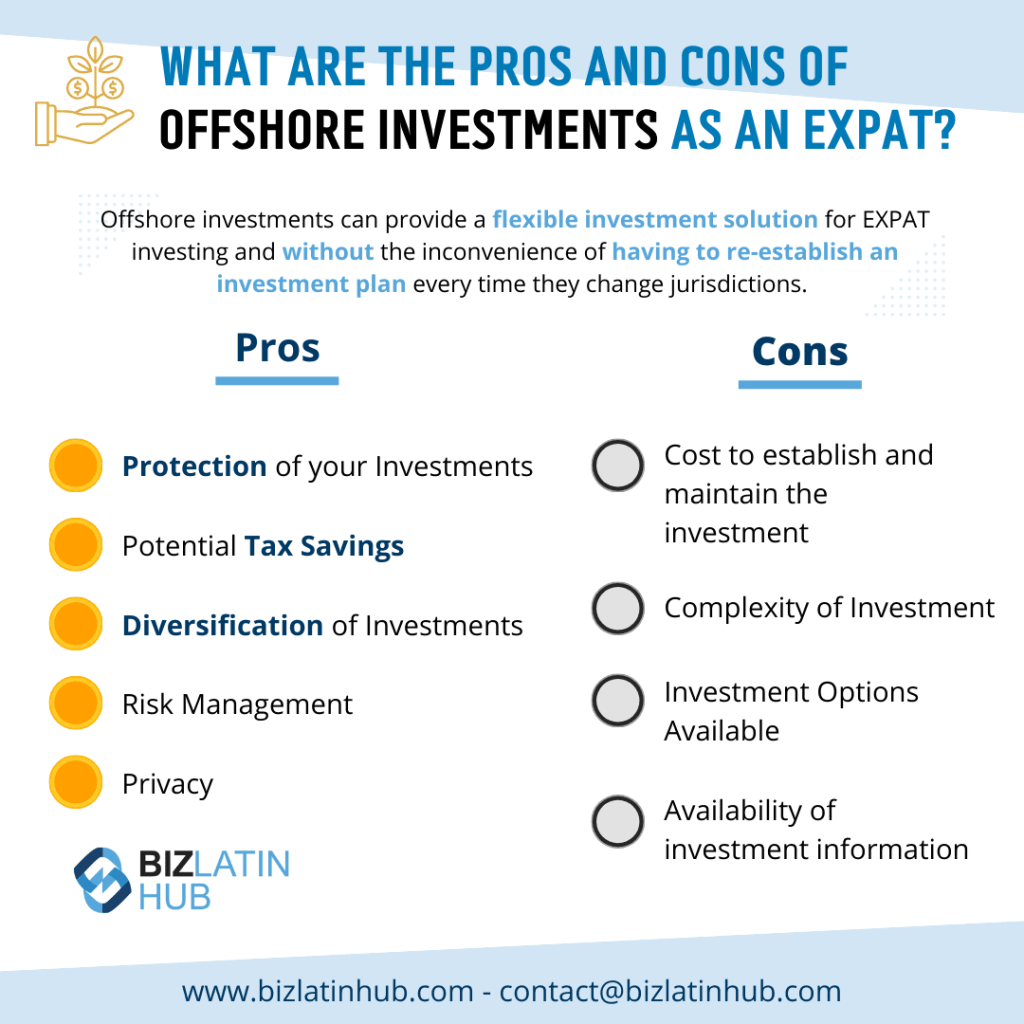

In a significantly globalized economic climate, understanding the different sorts of offshore financial investments is vital for efficient riches monitoring and possession defense. Each investment lorry, from overseas checking account to shared funds and trust funds, offers unique features tailored to satisfy varied financial objectives. The subtleties of these options can significantly influence tax obligation obligations and run the risk of exposure. As we discover the ins and outs of each kind, it comes to be obvious that the ideal choice can bring about boosted financial safety and security and possibilities. What, after that, are the details benefits and factors to consider that establish these offshore investments apart?

Offshore Bank Accounts

Offshore financial institution accounts function as a critical financial device for companies and individuals looking for to expand their properties and manage currency risk. These accounts are normally established in jurisdictions that provide beneficial banking laws, privacy securities, and a secure political and financial setting. By holding funds in diverse money, account owners can properly minimize the risks connected with money variations, making sure greater economic security.

However, it is important to abide by all pertinent tax obligation laws and regulations when making use of overseas banking solutions. Failure to do so may result in lawful effects and financial penalties. Possible account holders need to seek specialist recommendations to browse the complexities of offshore banking and guarantee they are fully certified while gaining the benefits of asset diversification and danger administration.

Offshore Mutual Funds

Spending in mutual funds can be an effective method for people seeking to accessibility global markets while taking advantage of professional monitoring and diversification. Offshore common funds act as an engaging option for financiers seeking to take advantage of opportunities beyond their domestic markets. These funds pool capital from multiple financiers to buy a diversified portfolio of assets, which may consist of equities, bonds, and alternate investments.

Among the key advantages of overseas common funds is the potential for boosted returns with accessibility to international markets that may not be readily available locally. These funds usually offer tax advantages depending on the territory, enabling investors to optimize their tax obligation responsibilities. Professional fund managers actively handle these financial investments, making informed choices based on strenuous research and market evaluation.

Investors in offshore shared funds take advantage of the adaptability to choose various fund methods, ranging from traditional to hostile investment techniques. This range enables people to straighten their financial investment choices with their risk resistance and monetary objectives. It is crucial for capitalists to conduct detailed due diligence and understand the governing atmosphere, charges, and risks associated with these investment vehicles before dedicating resources.

Offshore Trust Funds

Counts on represent a tactical financial device for people seeking to handle and secure their possessions while potentially taking advantage my company of tax effectiveness. Offshore Investment. Offshore trusts are established outside the individual's home country, enabling enhanced possession defense, estate preparation, and privacy benefits. They can safeguard properties from creditors, legal cases, and separation negotiations, making them an attractive choice for wealthy people or those in risky occupations

Furthermore, overseas depends on can supply substantial tax benefits. Depending upon the territory, they might provide positive tax therapy on earnings, resources gains, and inheritance. It is crucial to browse the lawful complexities and compliance needs linked with offshore depends on, as failing to do so can result in severe penalties. Seeking specialist recommendations is vital for any person considering this financial investment approach.

Offshore Realty

An expanding number of investors are transforming to realty in international markets as a means of diversifying their profiles and taking advantage of on worldwide possibilities - Offshore Investment. Offshore real estate financial investments supply numerous advantages, consisting of possible tax obligation benefits, property protection, and the chance to acquire buildings in arising markets with high development capacity

Buying overseas property enables individuals to take advantage of desirable residential property laws and guidelines in specific jurisdictions. Lots of countries supply motivations for foreign financiers, such as lowered tax on resources gains or earnings generated from rental properties. Additionally, having real estate in a foreign country can offer as a bush versus money variations, giving security in volatile economic climates.

Additionally, offshore property can create paths for residency or citizenship in specific territories, improving individual and economic wheelchair. Financiers commonly look for properties in prime locations such as urban centers, playground, or regions undertaking significant growth, which can yield appealing rental returns and long-lasting gratitude.

Nonetheless, potential financiers should carry out comprehensive due diligence, recognizing regional market conditions, lawful structures, and home monitoring implications to optimize their offshore actual estate financial investments properly.

Offshore Insurance Policy Products

Exploring offshore insurance items has come to be a progressively prominent strategy for services and people looking for improved economic safety and security and property security. These items use distinct benefits, consisting of tax obligation advantages, privacy, and flexible investment choices customized to individual or company requirements.

An additional significant group consists of health and traveling insurance coverage, which may use comprehensive protection and securities not readily available in the insurance policy holder's home nation. These products can be particularly useful for migrants or constant vacationers who encounter unique risks.

Ultimately, overseas insurance products provide an engaging choice for those aiming to strengthen their monetary strategies. By supplying tailored options that stress privacy and tax effectiveness, they can play a vital role in a varied financial investment profile.

Verdict

In final thought, offshore investments existing varied chances for wide range administration and property security. Understanding the unique functions of each overseas financial investment is important for people and entities seeking to browse the complexities of worldwide finance successfully.

In an increasingly globalized economy, comprehending the numerous kinds of offshore financial investments is vital for effective riches administration and property protection. Each investment lorry, from offshore financial institution accounts to common funds and counts on, supplies see unique functions tailored to satisfy varied economic goals.Additionally, overseas financial institution accounts can offer access to a range of monetary solutions, consisting of financial investment possibilities, offering facilities, and wealth monitoring solutions.Financiers in overseas mutual funds profit from the adaptability to choose various fund strategies, ranging from traditional to hostile investment approaches. Recognizing the distinct features of each overseas investment is necessary for entities and individuals seeking to browse the intricacies of global money efficiently.

Report this page